Digital Transformation For Banks

Technology underpins the creation of the.

Digital transformation for banks. An efficacious digital transformation begins with an understanding of digital customer behavior preferences choices likes dislikes stated as well as unstated needs aspirations etc. Britain has long been recognised as one of the most innovative and fast moving fintech sectors in europe. In addition digital transformation brings about fundamental changes in working modes and business models of the financial sector. To stay ahead executives know they need digital transformation.

Thats not easy to accomplish but can be well worth the effort. And this transformation leads to the major changes in the organizations from product. But change isnt easy. At the same time they must manage the risks created by the new digital economy.

Companies that fail to adapt can quickly be left behind. There is no doubt new digital technologies are changing the banking. Ibm digital reinvention helps your business to exceed customer expectations drive new revenue opportunities and adopt fearless experimentation. Learn more on how 01 systems can help you with banking solutions that you can rely on in your digital transformation journey.

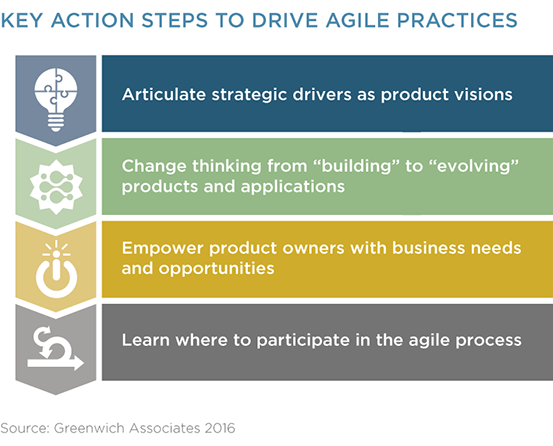

The digital transformation of any enterprise is a herculean task requiring a willingness to embrace cultural change the ability to immerse the entire organization in the customer journey and a total commitment to digitize to the core. Digital transformation by year 2021 3 billion people are expected to use digital banking channels in some form or the other. In a digital driven bank or credit union digital is treated as a priority that needs a clearly articulated strategy funding talent agile ways of working and an organizational culture that is willing to take risks. Dbs bank chief information officer david gledhill shares his insights on dbss digital transformation with mckinseys vinayak hv a partner in the.

The four pillars of digital transformation in banking. But pwcs george hodges banking fintech lead and justin oconnor digital banking lead both agree theres really only one way forward and thats through a digital transformation. Banks and credit unions that digitize can achieve a 20. Reinvent for new value.

Banks need to remain digital leaders. Our survey shows that 87 percent have a formal long term plan for digital innovation. If youre interested in how to help banks drive digital transformation with cloud based analytics please read my previous blog post here. It is a vital change in how banks and other financial institutions learn about interact with and satisfy customers.

Its foundational to their competitiveness. Pursuing a digital transformation is the critical path for banks to boost roe. Banking the rising popularity of uk bank transfers. As a central bank with a mandate to ensure price stability it is important that we are able to gauge such developments and anticipate possible repercussions.

There is a critical need for affordable computing platforms that provide greater agility. Banks are racing to take advantage of market opportunities available through digital transformation. For banks digital transformation isnt just about improving efficiency or controlling costs. Established banks are challenged by new agile players.

Those can be your customers too but the question is are you ready.