Banking System Money Creation

Money creation and the shadow banking system the harvard community has made this article openly available.

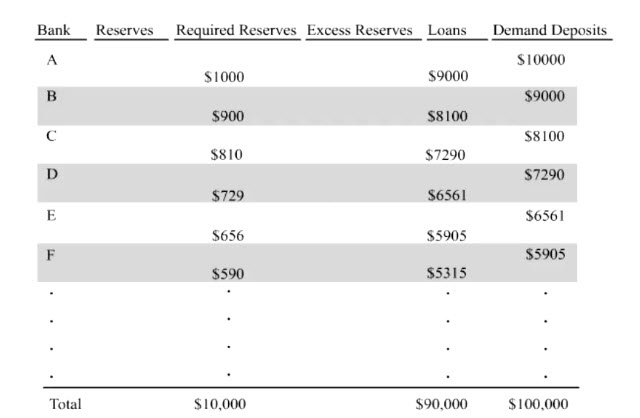

Banking system money creation. The money multiplier is defined as the quantity of money that the banking system can generate from each 1 of bank reserves. Much of the. The money multiplier and bank loans. Money creation by the banking system.

Please share how this access benefits you. Acme bank bellville bank and clarkston bank. We will focus on three banks in this system. Your story matters citation sunderam adi.

We will focus on three banks in this system. Acme bank bellville bank and clarkston bank. This paper assesses the central premise of this argument. Money creation and the shadow banking system adi sunderam harvard business school asunderamathbsedu september 2013 abstract it is widely argued that shadow banking grew rapidly before the recent nancial crisis because of rising demand for money likeclaims.

The quantity of money in an economy and the quantity of credit for loans are inextricably intertwined. Assume that all banks are required to hold reserves equal to 10 of their checkable deposits. To understand the process of money creation today let us create a hypothetical system of banks. To understand the process of money creation today let us create a hypothetical system of banks.

Money creation and the shadow banking system review of financial studies 28 no. We now present an alternative way of describing the working of the money multiplier by showing how adjustments by banks and the public following an increase in the monetary base produce a multiple expansion of the money stock. In this video we illustrate the process by which money is created in a fractional reserve banking system. Due to the fact that at any given time a bank must only keep a certain percentage of its.